London is a global financial center, housing numerous industries and businesses that contribute to its thriving economy. Notably, it has established itself as one of the most transparent and biggest commercial real estate markets in the world, attracting both domestic and international investors. Market valuations tend to adjust more quickly to a changing environment such as higher interest. The market correction has occurred on a larger scale in the UK than in continental Europe, and we are seeing sellers slowly accepting the new normal. However, there is still a mismatch between buyer and vendor expectations, in terms of pricing, which continues to hold down transaction volumes. This slow transaction activity, in turn, we believe to offer opportunities. However, London office volumes have shown a rising monthly trend in contrast to Continental Europe.

We believe that now is an opportune time to buy for several reasons. Firstly, the slow activity on capital markets has led to a buyer's market for the first time in several years, providing access to assets that would not typically be available in normal market environments. According to recent data from Colliers, 82 % of properties on offer in Q1 2023 were valued at over £ 100 million, and 95 % of buyers were foreign investors, primarily from Asia and Europe. With national investors remaining on the sidelines, the low transaction activity provides a unique opportunity for cash-rich international investors to capitalize on favorable pricing.

Secondly, while prime yields published in the media remain stable at 4.50 % in the City and 4.00 % in the West End, recent on-the-ground experience has shown that motivated sellers are willing to negotiate pricing way above 6.00 % NIY for Class A office buildings in West End and > 6.50 % in the City. This further indicates a buyer's market and the potential for lucrative investments. Furthermore, we anticipate that capital markets will stabilize within the next 12 - 24 months. Meaning that despite continuing inflationary pressure, interest rates, which have recently been increased to 4.5 % by the Bank of England, are likely to remain on this level in the short-term and will come down in the mid-term.

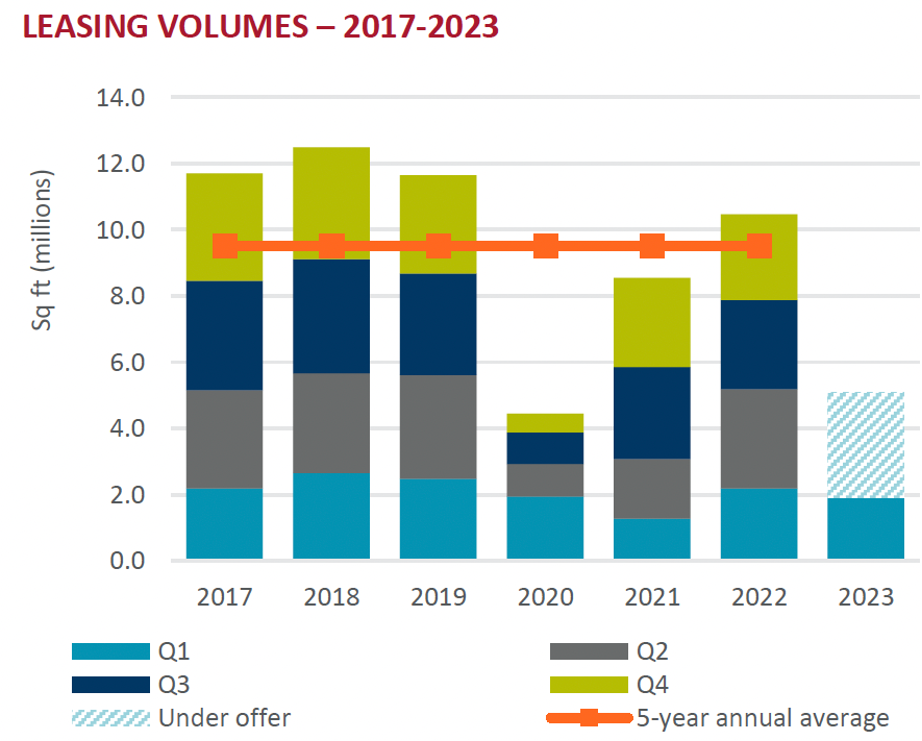

Thirdly, while the fundamental occupational markets may not be as strong as they were pre-COVID, the 12-month rolling take-up figure remains above 10 million sq ft in central London. According to C & W, 11 pre-let transactions completed during the quarter, two of which were over 100,000 sq ft – TikTok’s 139,000 sq ft deal in Clerkenwell and Pimco’s 106,000 sq ft transaction in Marylebone. Both deals, in addition to two other pre-lets, made up the top four transactions in Q1. The Banking & Finance, Professional Services, and Media sectors remain the most important in London, and the City took the largest market share (57 %) with over 1 million sq ft taken up, while the West End’s 688,344 sq ft accounted for 36 % of Q1 leasing volumes.

In conclusion, we believe that the current short-term market turmoil, the UK commercial real estate market presents attractive opportunities for anti-cyclical investors who are cash rich, to enter the market at attractive pricing. With the potential for lucrative investments in prime locations, motivated sellers open to negotiation and continuing strong demand from tenants for high-quality space at excellent locations, the market is ripe for those with a long-term investment strategy.